Services

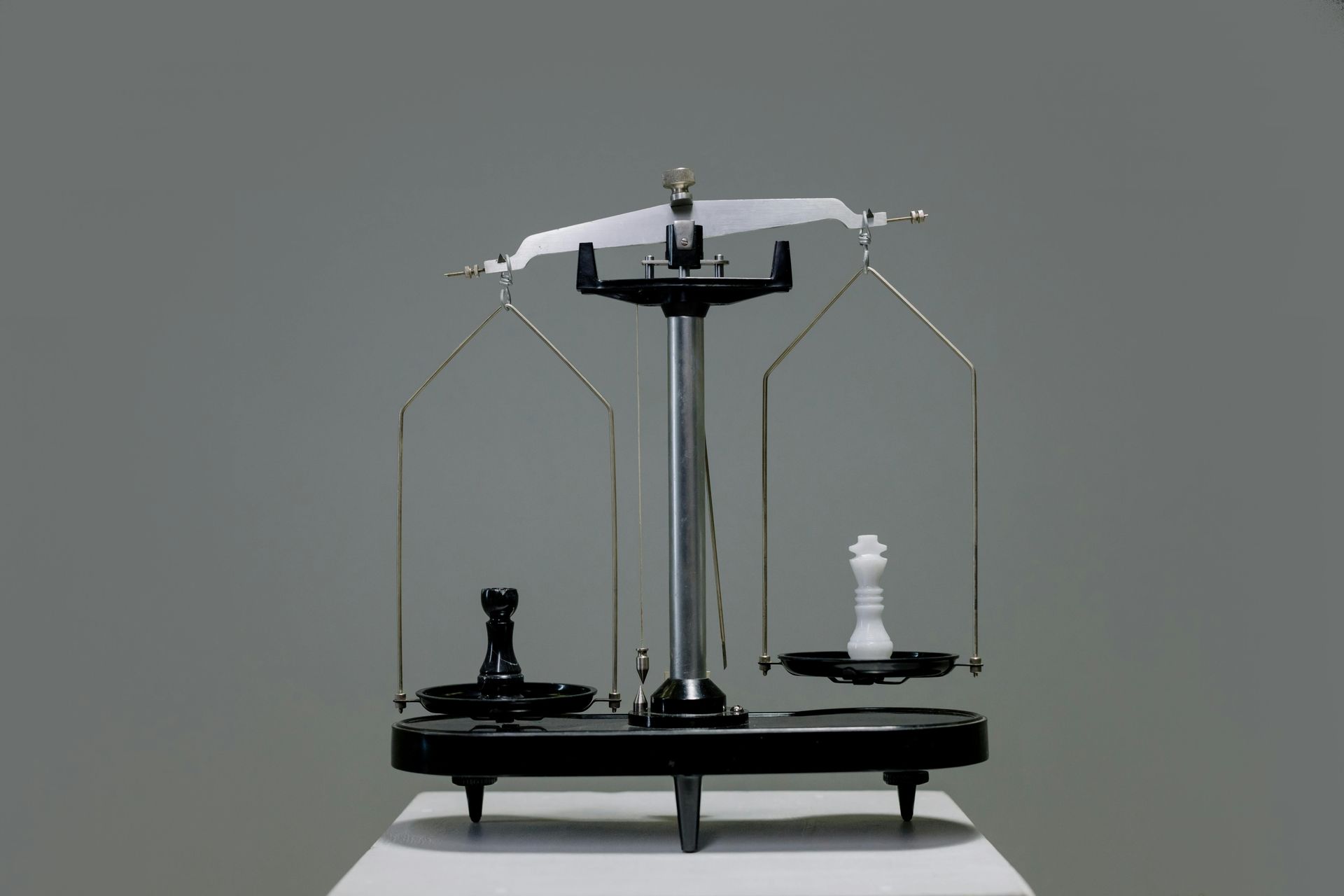

Stewardship for the Wealth You’ve Inherited

Calm, conservative, and coordinated financial guidance for heirs and beneficiaries.

Inheritance Transition Planning

Clarify your new financial position with a structured roadmap.

Conservative Investment Strategies

Balanced, low-risk portfolios that preserve family wealth.

Trust & Estate Coordination

Collaborate with your attorney and CPA.

Tax Optimization

Manage step-up in basis, IRAs, and capital gains efficiently.